Chicago Public Schools has borrowed $725 million by ensuring investors unusually high rates of interest.

Heather Gillers writes for the Chicago Tribune that bonds that are presented by entities such as CPS are ordinarily considered to be sound properties, but this is a school district that is sorely in debt, in political chaos, and with an unstable labor force.

“This is not a typical municipal bond,” said Matt Fabian, a partner at Concord, Mass.-based Municipal Market Analytics. “You can’t go into it assuming that you know what’s going to happen or that you will almost surely get your money back. There is a large degree of speculation.”

Records that became available last Wednesday revealed that CPS sold 28-year bonds with yields of 8.5%. The bond issue that was pulled last week had CPS offering 25-year bonds at 7.75%, compared to the state of Illinois that sold 25-year bonds earlier in the month at yields of 4.27%.

Bond issues are constructed of individual bonds that mature at varying times. The borrowing parties pay increased rates for bonds that mature in later years.

Moody’s Investors Service lowered the district’s bond rating last week to four levels below junk status because CPS’ rating has been falling for several months. Based on similar ratings in the past, 12% of municipal borrowers with this same rating have defaulted within five years, reports an analysis by the rating agency.

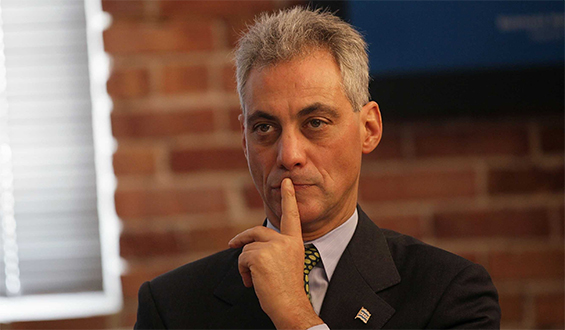

According to Republican Gov. Bruce Rauner, CPS and Mayor Rahm Emanuel have once again “kicked the can” down the road. But the district’s vice president, Ron DeNard, said borrowing money is never a task that is taken lightly, reports Associated Press.

Some of the borrowed money will be used for payments on old debts. The original amount the district hoped to secure from bond sales was $875 million.

To object to investments the district made with Bank of America, union members gathered at the Bank of America in the city’s financial district. They withdrew thousands of dollars and closed the union’s account. From the Bank of America branch on LaSalle Street, the protestors took $726,000 and transferred it to Amalgamated Bank.

CPS says the bond sale, along with the $100 million in cuts that were announced last Tuesday, will allow the district to get through the year by offsetting the debt.

But Rauner emphasized that he was still considering getting bills passed in the General Assembly that would allow state takeover of the district and require CPS to declare bankruptcy. But John Cullerton, president of the Senate, said his chamber would not vote for such a bill, nor would the Democratic-controlled House, write Leah Hope, Chuck Goudie, and Charles Thomas, reporting for WLS-TV Chicago

“You watch what Democratic legislators around the state who are not from Chicago like the speaker and the president are, you will see that that bill, that bill is not dead on arrival as some are trying to claim,” Rauner said.

Bloomberg reports that CPS has been running out of cash because of years of drawing down reserves and shortchanging teachers’ pensions. Because of the bad financial decisions, the districts’ annual payment has spiraled, and CPS has had to borrow to cover budget deficits.

Part of the problem that led to the district having to pay exorbitant amounts for a scaled-down bond issue is the poor condition of Chicago schools. Part of that, suggest some city aides, is because the governor has relentlessly suggested that CPS file for bankruptcy.